Definition

2 important criteria as specified in the investment advisers act of 1940:

the IA’s principal business must be giving investment advice. Basically excludes financial planners and others for whom investment advice is only part of what they do

provide investment supervisory services.

- More specifically per the SEC’s definition:

- you provide continuous and regular supervisory services if you

- have discretionary authority over and provide ongoing supervisory or management services with respect to the account

- do not have discretionary authority, but you have an ongoing responsibility to select or make recommendations, based upon the needs of the client, as to specific securities and, if such recommendations are accepted by the client, you are responsible for the purchase or sale.

- you do not provide continuous and regular supervisory services if you

- (a) provide market timing recommendations, but have no ongoing management responsibilities

- (b) provide only impersonal recommendations (e.g. market newsletters)

- (c) make an initial asset allocation , without continuous market monitoring or reallocation

- (d) provide advice on an intermittent or periodic basis (e.g. in response to a market event or on a specific date, like quarterly)

- have discretionary authority over and provide ongoing supervisory or management services with respect to the account

- you provide continuous and regular supervisory services if you

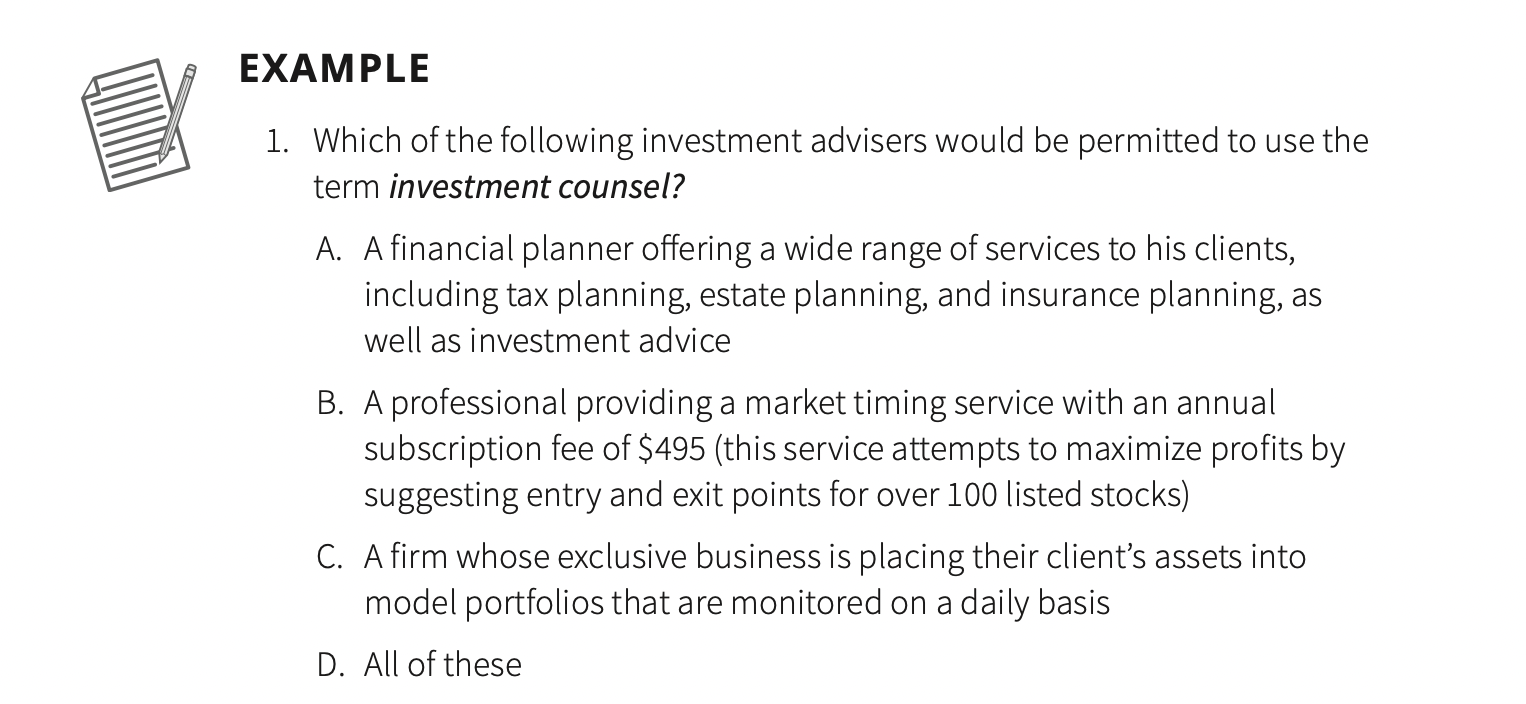

Example Question

Answer

C